Unemployment Insurance Benefits an Overview.

Unemployment Insurance benefits are designed first to alleviate the hassle for unemployed workers and their families. In the early stages of recession and recovery, however, they provide an additional benefit: stimulating economic activity and job creation.

What is Unemployment Insurance (UI)?

Unemployment insurance (UI), also known as unemployment benefits, is a type of state-provided insurance that pays individuals on a weekly basis in the event of losing a job and meeting certain qualification requirements. Those who have either quit their jobs or have been fired for justifiable reasons are not eligible for UI. In other words, a job usually qualifies for unemployment benefits due to lack of available work and separation from the job without any fault of its own.

Each state operates its own unemployment insurance program, despite it being a federal law. Workers must work on time, including their state work and wage requirements. The benefits are mainly provided by the state governments and are financed by a fixed salary tax levied for that purpose.

The federal government enacted provisions designed to help unemployed Americans during the coronavirus epidemic. These additional benefits came into effect after President Donald Trump signed the Coronavirus Assistance, Relief and Economic Protection (CARES) Act in March 2020. These were extended after the Consolidated Allocation Act of 2021 was passed, and when President Joe was extended again. Biden signed the 11 1.9 trillion American Rescue Plan Act on March 11, 2021.

Who is eligible for unemployment insurance?

An individual must meet the following requirements to be eligible for unemployment benefits:

- Unemployed through no fault of his own, and

- Works for a period of time usually up to 18 months and

- Each state has earned the minimum wage as prescribed and

- Actively looking for work every week you are reaping the benefits.

- Lost his or her own fault;

- "Able to work, available for work and actively looking for work;" And

- Earned at least a certain amount of money during the "base period" before becoming unemployed.

States apply these general parameters in a variety of ways. For example, while some states do not cover part-time workers if they are unwilling to take up full-time employment, other states allow these partners to qualify for another part-time job. Also, states have some preferences about the base time of work used to determine eligibility.

Since the late 1950s, less than half of the unemployed workers have actually received unemployment insurance, except during the recession. To be sure, unemployment insurance is not designed to cover all unemployed workers; It does not cover people who have voluntarily left a job, people who are looking for their first job, and re-entrants who have previously left the workforce voluntarily. But the growing percentage of unemployed workers who meet the basic criteria described above still fail to meet their state's eligibility criteria - established decades ago (in a completely different labor market) - making it even more difficult for UIs to meet.

In 1994, President Clinton and congressional leaders appointed a bipartisan advisory council on unemployment compensation to address these issues. The Commission identified a number of serious problems with UI eligibility and other regulations and recommended multiple reforms. While some states have established some reforms, the federal government has not made any extensive efforts to consider the recommendations any time soon. The 2009 Recovery Act provided the available 7 billion available through 2011 that modernized their unemployment insurance law to increase eligibility; Under this provision, 38 states plus Washington, DC, Puerto Rico and the U.S. Virgin Islands received federal funding.

Requirements for Unemployment Insurance (UI)

An unemployed person must meet two basic requirements to be eligible for unemployment insurance benefits. An unemployed individual must meet the state-mandated threshold for earning wages or working for a fixed base period. The state also has to determine that the eligible person is unemployed through any fault of their own. An individual can file an unemployment insurance claim while meeting these two requirements.

Individuals submit claims where they work. A participant can file a claim over the phone or on the website of the state unemployment insurance company. After the first application, it usually takes two to three weeks for the claim to be processed and approved.

After a claim is approved, the participant must report weekly or bi-monthly to confirm the test or their employment status. To be eligible for benefits, you must submit reports. An unemployed worker cannot refuse work within a week and must report any earnings from their freelance or consultation jig on each weekly or bi-weekly claim.

What are the benefits of unemployment insurance?

Regular benefits last 26 weeks in most states, although in 2019 ten states reduced their maximum possible duration below 26 weeks. The average weekly benefit was about 36 9,369, which replaces the previous wages of about 45% of unemployed workers on average.

Extended benefits may be available during the first period of regular benefits as well as during high unemployment. This part of the program, which has helped workers face unusual challenges during the economic downturn, allows an individual to provide an additional 13 weeks of benefits after expiring his or her 26-week maximum regular benefits period. States may decide to extend benefits within a further 13 weeks during a deeper economic downturn.

During the recent recession, Congress enacted an Emergency Unemployment Compensation Program (EUC), which gave some claimants the power to receive unemployment insurance benefits for a maximum of 99 weeks.

Example: Mike Jones has been fired from his factory job. He has used his regular 26 week benefits. Because he is in a state with high unemployment, he has qualified for another 13 weeks, bringing his total benefit period to 39 weeks. In addition, Congress has approved a temporary increase in unemployment compensation for any worker who uses all benefits and is still looking for a job, providing a further 13 weeks. If Jose is still unemployed, he can use these 13-week benefits, giving him a total of 52 weeks of unemployment insurance.

The Hidden Benefits of Unemployment Insurance

After social security and government-sponsored hospitals, unemployment insurance (UI) is the third largest government program for transferring funds to the poor. Although the program is sometimes criticized for diminishing job-seeking motivation, economists over the years have blamed it on a lot of social benefits. UI has recently provided groceries, gas and clothing purchasing materials to the unemployed, continuing to drive overall consumer spending, which could be particularly helpful in the recession. It also provides resources for job seekers to infuse less volunteer opportunities while hunting for suitable positions.

Recent research by a team that includes professors from two Kellogg Schools of Management suggests that UI's social benefits have been greatly enhanced beyond previous beliefs. The expansion of the UI "played an important role in preventing forecasting during the Great Recession," said Brian Melzer, an assistant professor in the Department of Finance. Melzer and David Matsa, associate professors of finance, participated in the study with Joanne Hsu, of the Federal Reserve Board of Governors in Washington, DC.

Researchers estimate that between 2007 and 2012, the program helped avert $70 billion in social spending from forecasting, including devaluing the structural value of predicted assets, devaluing neighboring homes, and transaction costs paid by donors and families. In addition, the expansion improves credit access for a wider clientele of the poor, even those who have never had to take out insurance. In a broader sense, the study argues for the effectiveness of public policies such as unemployment insurance, which improves their ability to pay their debts, as opposed to improving their incentives to pay their debts.

Income risk and default

The research project began with the intuitive feeling that Melzer explained, "Reducing the risk of family income will reduce defaults." But he added: "It was uncertain how big the impact would be." Since the study began, no one has yet investigated the link between mortgage defaults and employees ’job histories. Making that connection enables researchers to provide new insights.

To determine the extent of the relationship between income risk and default, the researchers used the fact that there are differences between states in the level of unemployment insurance. In the Basic Program, unemployed people can receive half of their income for up to six months if they do not get a job. However, the weekly benefit is subject to cap. As a result, the total benefits currently available range from $6,000 in Mississippi to $28,000 in Massachusetts. In response to the Great Depression, the federal government assisted the states in providing additional payments to the states, including the amount dependent on the unemployment rate. The government provided additional funding that increased the duration of the UI. For example, during the time the researchers studied, the recipients qualified for 20 additional week benefits of up to $6,000 in South Dakota, but the new case has 53 additional week benefits worth 31 31,000. Employed by 2011 and looking for trends in mortgage crime for unemployed families and matching these differences in these states with them.

Impact for housing policy

The results show an important correlation between UI and improved financial situation for individuals. The impact on housing is surprisingly large. A 3.00 increase in a state's maximum regular UI benefits prevents an average of 15% of mortgage losses due to pruning. In the long run, it helps reduce the prognosis among unemployed homeowners. "These effects are large-scale," the researchers write. "When he increased the eviction scenario, a subset of the default associated with the pruning was cut in half."

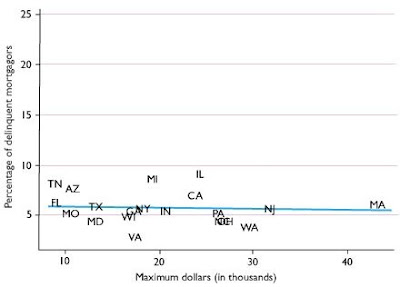

[The figures below show the relationship between the maximum UI benefits a household has in a given state and the percentage of criminal mortgages in that state (as of May 2009). With the highest UI rise, criminal mortgages have decreased - but only among households that have experienced unemployment]

Family unemployment experience

Households Experiencing No Unemployment

The effect even applies to mortgage holders who owed significantly more than the value of their home. "A policy like UI that improves a household's ability to repay households is effective even for families who are deeply indebted and in debt over mortgages," says Melzer.

Interestingly, UI provides mortgage relief more effectively than programs dedicated to that goal, such as the Home Affordable Rescheduling Program and the Home Affordable Conversion Program. In doing so, the team transfers money directly to homeowners, bypassing lenders and loan services. “We are not saying that UI is the right policy to prevent mortgage predictions. UI recipients have half the rent or no mortgage. But the impact - avoiding the 1.4 million forecast - is too big to avoid, "Matasa said.

In addition to the social benefits of avoiding prognosis, these effects have also reduced the cost of providing UI to needy households. Because of this, the federal government effectively guarantees the payment of many mortgages through Fannie Mae and Freddie Mac, preventing foreclosures and offsetting some of the money saved in the UI. “We estimate that avoiding forecasting reduced the cost of raising UI by about 20 percent during this Great Depression,” Matasa said.

Outside of housing

However, the benefits of UI are not limited to the unemployed or, in this case, their neighbors, communities and donors. Unemployed borrowers have an additional consequence of unemployment insurance by reducing the chances of defaulters: it improves the creditworthiness of people at risk of being laid off.

By analyzing mortgages, credit home equity lines, and credit card loans, researchers were able to determine if households, even without loss of employment, enjoyed extended access to credit with lower interest rates and higher credit limits. Overall, interest rates fell 1.4 percent, and the credit limit increased to $1,600 for every $3,600 increase for the maximum UI facility. Households that earn less than $ 35,000 a year have significantly reduced interest rates and increased credit limits.

The study suggests that, in addition to the cost of implementing and expanding the UI, the program provides a broader social value than previously understood. Policy makers should keep these benefits in mind as they consider programs that provide direct financial support for individuals seeking to return to the black. “As housing spreads out of default, our research shows that UI benefits the unemployed and the overall financial system,” Melzer said. “You don’t have to lose your job to benefit from unemployment insurance,” Matasa added. "People often benefit from social insurance even if they don't pay."

Related Topics

0 Comments