International Strategy: Creating Value in Global Markets (Chapter-7)

Topics

I.The Global EconomyII.Factor’s Affecting a Nation’s Competitiveness

III.International Expansion: A Company’s Motivations and Risks

IV.Achieving Competitive Advantage in Global Markets

V.Entry Modes of International Expansion

VI.Cultural difference measures

I.The Global Economy: A Brief Overview

Globalization1.the increase in international exchange

–including trade in goods and services

–exchange of money, ideas, and information.

2.the growing similarity of laws, rules, norms, values, and ideas across countries

- Economies of East Asia have attained rapid growth.

- Indian & Chinese economies growing importance.

- Trade Agreements NAFTA, ASEAN, EU & the Euro (€) APEC, Mercosur, CAFTA-DR Internet technologies & Information flow Income in Latin America grew by only 6 percent in the past two decades.

- Average incomes in sub- Saharan Africa and the old Eastern European bloc have actually declined

II. Factor’s Affecting a Nation’s Competitiveness

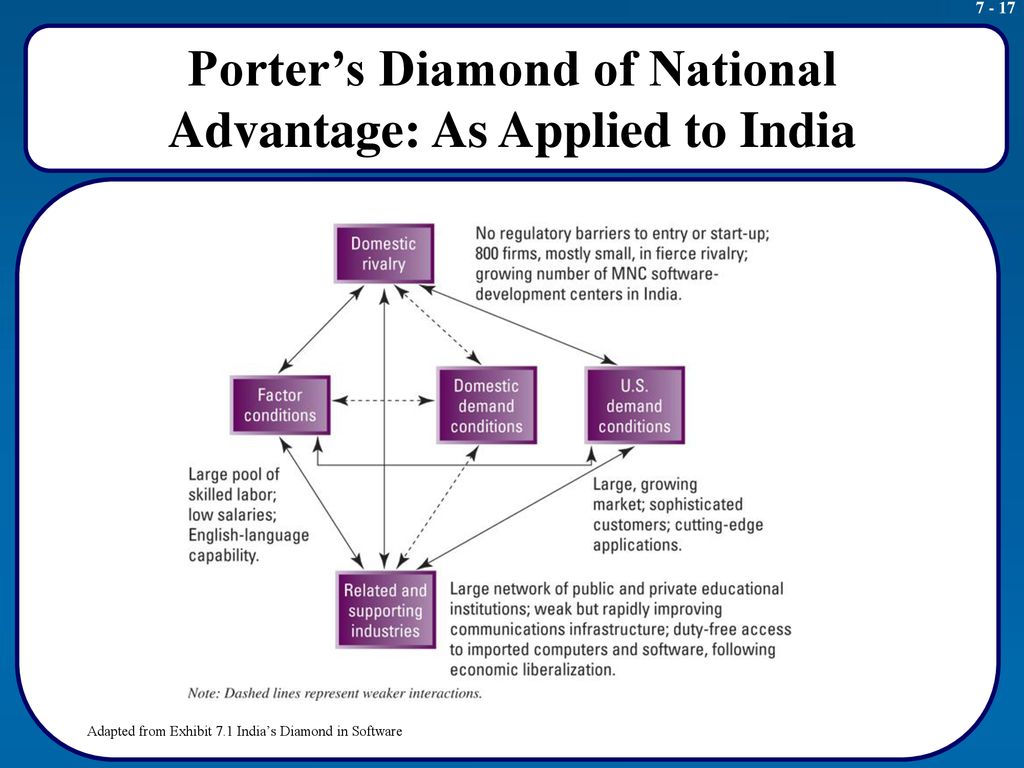

Porter’s Diamond of National Advantage:

- Factor endowments

- Demand conditions

- Related and supporting industries

- Firm strategy, structure, and rivalry

These attributes jointly determine the playing field that each nation establishes and operates for its industries.

Factor endowments –The nation’s position in factors of production, such as skilled labor or infrastructure, necessary to compete in a given industry.

Demand conditions –The nature of home-market demand for the industry’s product or service.

Related and supporting industries –The presence or absence in the nation of supplier, support, and and other related industries that are internationally competitive.

Firm strategy, structure, and rivalry –The conditions in the nation governing how companies are created, organized, and managed, as well as the nature of domestic rivalry.

Factor Conditions

To achieve competitive advantage, factors of production must be created

–Industry specific

–Firm specific

The pool of resources at a firm’s or country’s disposal is less important than the speed and efficiency with which the resources are deployed.

Demand Conditions

- Demands that consumers place on an industry for goods and services

- Demanding consumers drive firms in a country to

–Meet high standards

–Upgrade existing products and services

–Create innovative products and services

Related and Supporting Industries

- Enable firms to manage inputs more effectively

- Allow joint efforts among firms

- Strong supplier base adds efficiency to downstream activities

- Competitive supplier base lets a firm obtain inputs using cost-effective, timely methods

Firm Strategy, Structure and Rivalry

- Strategy: Low cost leader, Differentiator, …

- Structure: International division, International department, …Global matrix

- Rivalry is intense in nations with conditions of:

–Strong consumer demand

–Strong supplier bases

–High new entrant potential from related industries

- Competitive rivalry increases the efficiency with which firms

–Develop within the home country

–Market within the home country

–Distribute products and services within the home country

III.International Expansion: A Company’s Motivations and Risks

- Increase the size of potential markets

- Attain economies of scale

- Taking advantage of arbitrage opportunities

- Extend the life cycle of a product

- Optimize the physical location for every activity in its value chain

- Potential Risks

–Currency

–Management

Potential Risks of International Expansion

Political and economic risk

–Social unrest

–Military turmoil

–Demonstrations

–Violent conflicts and terrorism

–Laws and their enforcement

Example: Transparency International Corruption Perceptions Index

The 2008 Transparency International Corruption Perceptions Index (CPI) reveals the most corrupt countries in the world. Corruption is defined by this index as the use of public office for private gains.

The scores range from ten (squeaky clean) to zero (highly corrupt).

The five most corrupt countries are

–Somalia (CPI Score: 1.0)

–Myanmar (CPI Score: 1.3)

–Iraq (CPI Score: 1.3)

–Haiti (CPI Score: 1.4)

–Afghanistan (CPI Score: 1.5)

The least corrupt countries are Finland, Iceland, and New Zealand

Currency risks

–Currency exchange fluctuations

–Appreciation of the U.S. dollar

–China does not allow yuan to float

Management risks -- potential threat to a firm’s operations in a country due to the problems that managers have making decisions in the context of foreign markets.

–Culture

–Customs

–Language

–Income levels

–Customer preferences

–Distribution system

International Managers

Why is international experience important for managers?

Why is cross-cultural understanding important for managers?

- Ethnocentric

- Polycentric

- Geocentric

Outsourcing & Offshoring

Outsourcing –occurs when a firm decides to utilize other firms to perform value-creating activities that were previously performed in-house.

Offshoring –takes place when a firm decides to shift an activity that they were previously performing in a domestic location to a foreign location.

IV. OPPOSING PRESSURES

Two Opposing Pressures: Reducing Costs and Adapting to Local Markets

Levitt’s suggestion: Strategies that favor global products and brands

–Should standardize all of a firm’s products for all of their worldwide markets

–Should reduce a firm’s overall costs by spreading investments over a larger market

Levitt’s Three assumptions

1.Customer needs and interests worldwide are becoming more homogeneous

2.People are willing to sacrifice product preferences for lower prices at high quality

3.Economies of scale in production and marketing can be achieved through supplying global markets

Assumptions not always true Product markets vary widely between nations A growing interest in multiple product features, quality and service Overall standardizations does not consider:

–Technology permits flexible production

–Cost of production may not be critical to product cost

–Firm’s strategy should not be product-driven

Opposing Pressures -- Four Strategies Integration-Responsiveness Framework

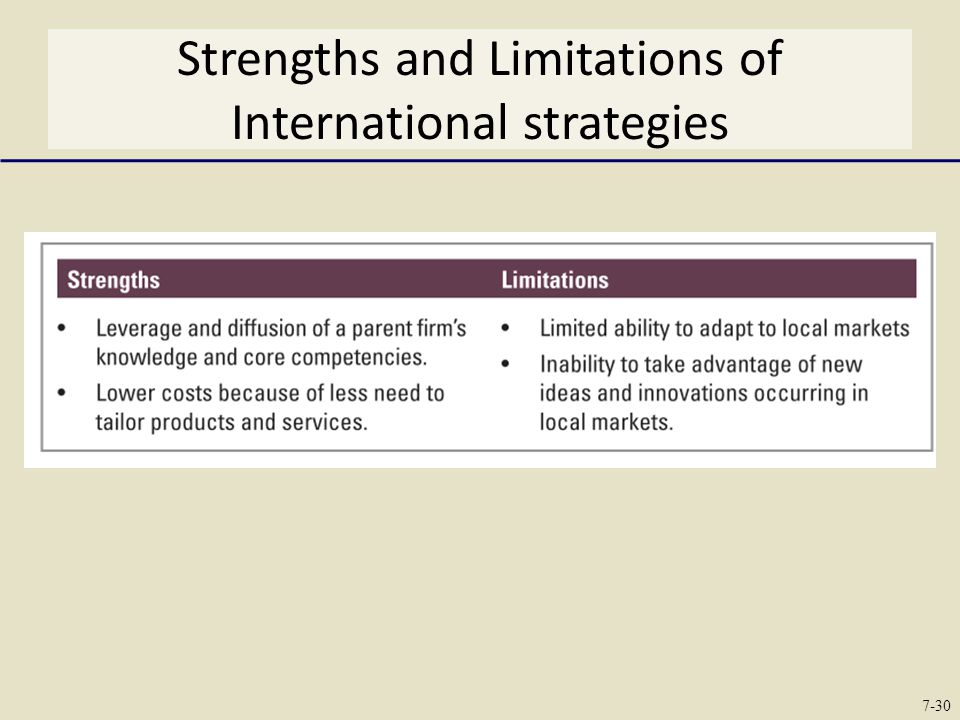

International Strategy

- An international strategy is based on diffusion and adaptation of the parent company’s knowledge and expertise to foreign markets.

- The primary goal of the strategy is worldwide exploitation of the parent firm’s knowledge and capabilities.

- Used in industries where the pressures for both local adaptation and lowering costs are low.

Strengths and Limitations of International strategies

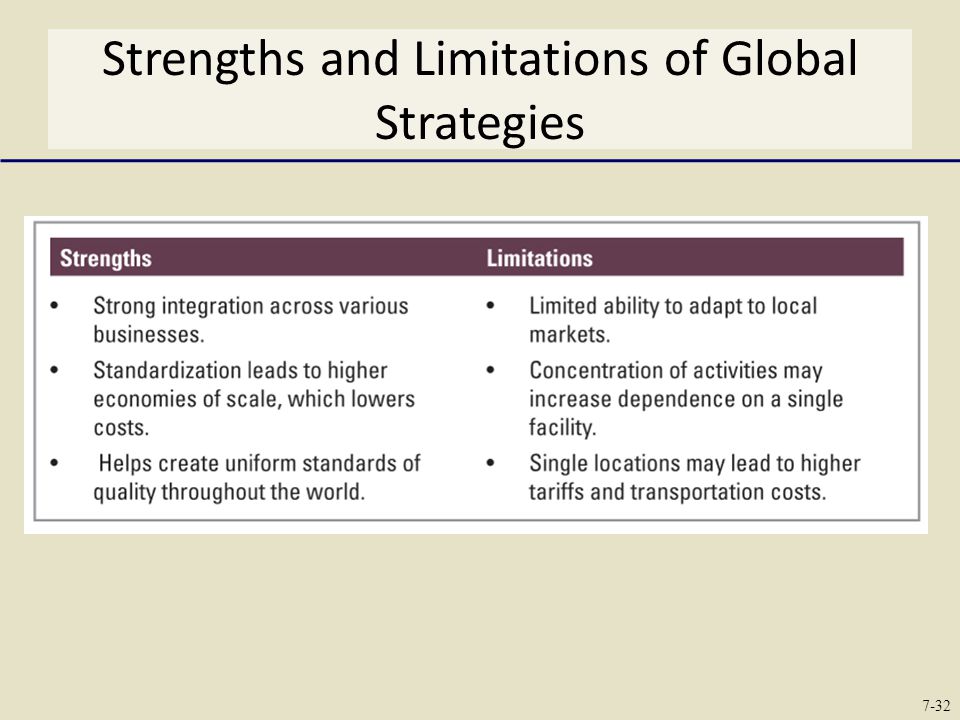

Global Strategy

- Competitive strategy is centralized and controlled largely by corporate office

- Emphasizes economies of scale / controlling costs

- Used in industries where the pressure for local adaptation is low and the pressure for lowering costs is high

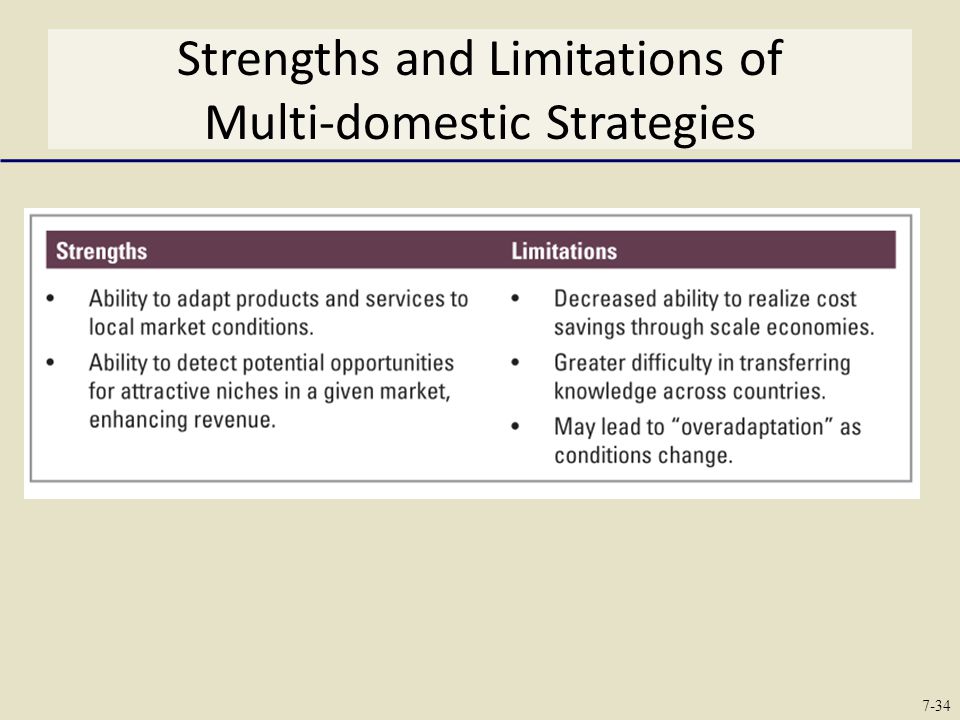

Multi-domestic Strategy

- Emphasis is differentiating products and services to adapt to local markets

- Authority is more decentralized

- Used in industries where the pressure for local adaptation is high and the pressure for lowering costs is low.

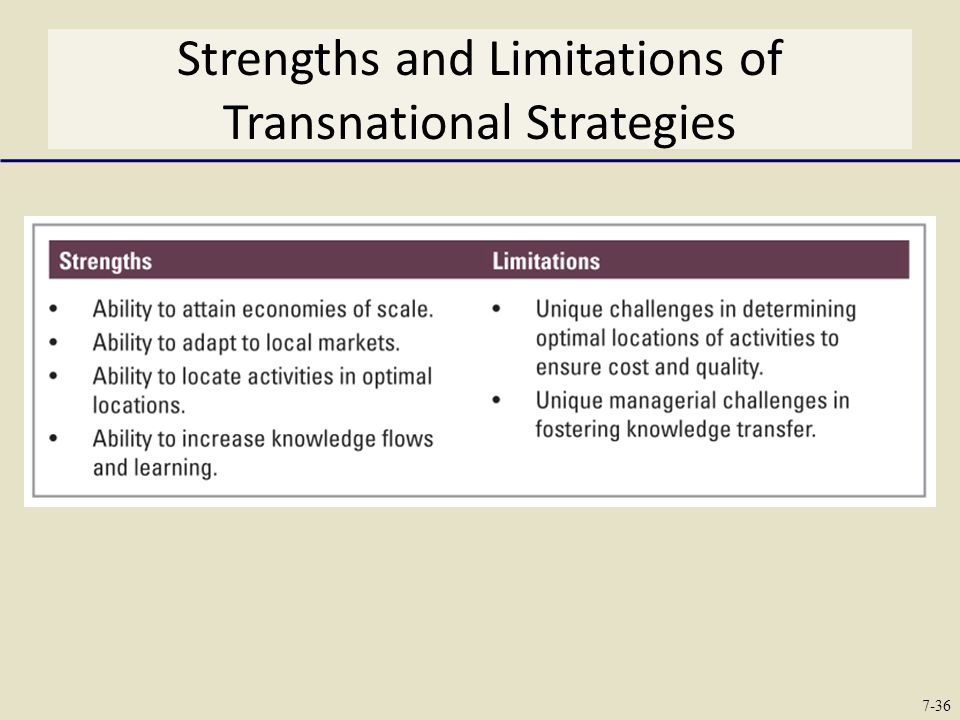

Transnational Strategy

- Optimization of tradeoffs associated with efficiency, local adaptation, and learning

- Firm’s assets and capabilities are dispersed according to the most beneficial location for a specific activity.

- Used in industries where the pressures for both local adaptation and lowering costs are high.

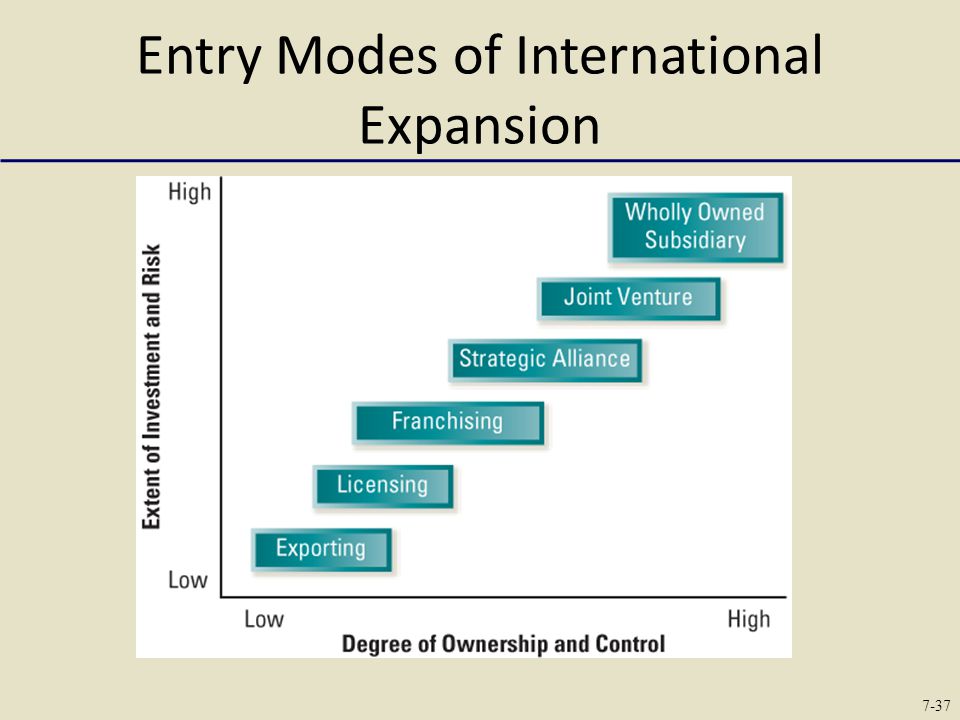

V. Entry Modes of International Expansion

Exporting –Producing goods in one country to sell to residents of another country.

Joint Ventures & Strategic Alliances (Chapter 6)

Wholly owned subsidiary

–a business in which a multinational company owns 100 percent of the stock.

–Acquire versus Greenfield

VI. CULTURAL DIFFERENCES

Cultural Difference Measures

Hofstede (5/6)

– Individualism/ Collectivism

– Feminine/ Masculine

– Power Distance

– Uncertainty avoidance

– Long-term/Short-term Orientation

– Indulgence/Restraint GLOBE (9)

– Institutional Collectivism

– In-Group Collectivism

– Assertiveness

– Future orientation

– Gender egalitarianism

– Uncertainty avoidance

– Power Distance

– Performance orientation

– Humane orientation

for more article visit: Business study notes

0 Comments